The fintechs had the chance to demonstrate how they leveraged their products and services within the program and their potential to transform the payments ecosystem. Throughout the Visa Innovation Program , fintechs managed to run pilot collaborations with leading financial institutions, successfully ran PoCs and built partnerships with each other.

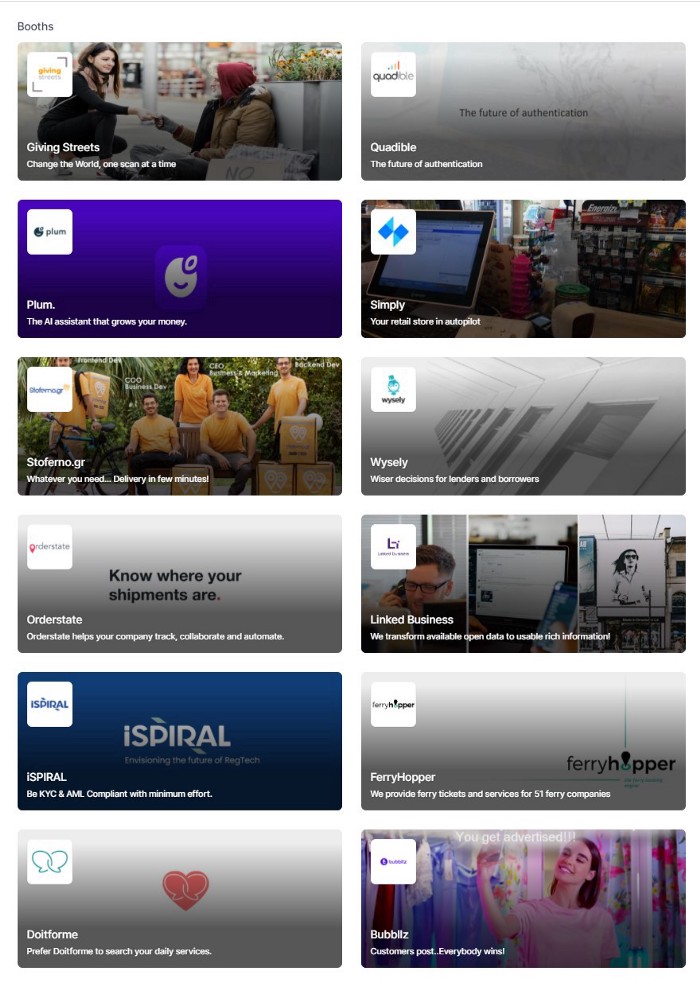

Αthens, 12 November 2020 — The Visa Innovation Program in Greece, powered by Crowdpolicy, organised on 11th of November its first Demo Day. The startups from the 1st cohort Bubbllz, Do it for me, Ferryhopper, Linked Business, Orderstate και Stoferno together with the ones from the second cohort Giving Streets, I Spiral, Plum, Quadible, Simply και Wysely (formerly known as Squaredev) presented their innovative solutions.

In the event a large number of members from the startup and fintech ecosystem, VC funds, Visa and Banks executives and stakeholders of the Program. participated.

Visa in partnership with Crowdpolicy, launched the Visa Innovation Program in March 2019, aiming to enable the local digital payments ecosystem, develop new solutions for cross border payments in tourism, retail and social sector through co-creation, open innovation methodologies and scale in the market, generating more convenient ways to pay and to be paid for consumers and businesses, in the private and public sector.

The fintechs enrolled in the two cohorts of the Visa Innovation Program collaborated extensively with the whole team of Visa Innovation Program, the mentors and the executives of the Visa. Two fintechs completed PoCs (Proof of Concept) with Visa and its partners and 5 more are expected to be completed by the end of the year. In addition, the second season appeared very fruitful in Startup2Startup collaboration, where 2 PoCs are on their way between the participating companies.

Behind the success of the Program are 70+ meetings with 35+ executives from Visa and its partnering Banks, 55 mentoring sessions, 14 workshops on specific fields from leading experts and 5 events to attract the interest of the fintech community. The entire program was tailored to the needs of the participating companies.

Sevdalina Vassileva, Visa’s General Manager for Greece, Cyprus and Bulgaria said: “At Visa, we have an extensive global innovation agenda and we believe that localizing it at the markets we operate in is very important. Fintechs are at the center of the digital payment ecosystem and Visa’s goal is to enable these companies to expand access to electronic payments and create new payment solutions, addressing not only consumers’ expectations for their purchases to become increasingly ‘invisible’, frictionless, but also enabling SMEs for digital commerce in the current Covid-19 context and bringing innovation closer to the traditional financial institutions. I would like to thank our client banks, partners from the investment community and various industries for the support and engagement with our Visa Innovation Program in Greece.”

Andreana Pappas, Head of Visa Greece commented: “The Visa Innovation Program is designed to leverage local fintech talent and develop solutions to transform digital payments in the market. This initiative allows us to leverage the capabilities of Greek fintechs to deliver solutions to market challenges and continue to shape the future of payments and commerce. Today during our first Demo Day in Greece, you had the opportunity to get to know the interesting solutions of the 12 startup companies that joined the program. We are happy that the Visa Innovation Program has opened great opportunities for them, such as partnering with leading banks and successfully completing PoCs. We are also glad that partnerships have emerged among Visa Innovation Program fintechs, demonstrating the collaborative nature of the program. Each company is unique and it is moving with different dynamics, but they all have huge potential to bring truly innovative solutions far beyond the borders of their physical geography.”

Michalis Psallidas, Crowdpolicy Managing Director said:“The Visa Innovation Program paved the way for the development of collaborations between fintechs, Visa and financial institutions. We had the opportunity to work intensively with 12 leading fintechs which are operating globally and already are in the phase of scale up, creating innovative applications and services for digital transactions and payments. The Visa Innovation Program is enabling the co-creation of solutions so that the fintechs can further develop their payment applications and experiences for the market, for businesses and public stakeholders, contributing to the economy and growth.”

Watch Demo Day!

Video of the Visa Innovation Program Demo Day

Visa Innovation Program operates as a collaborative platform where fintechs and Visa partners work together to address market-wide challenges with tangible solutions in the new changing economy. Fintechs enrolled in the program were provided with access to a wide array of mentors, experts, coaches, and Visa’s network, while receiving support on various areas such as business development, growth hacking, business advisory and technology integrations. Visa Innovation Program’s agenda is tailored according to the needs of the participating fintechs and brought by Crowdpolicy’s team of banking and fintech experts.

The companies were supported to develop their product through a sectorial 5-month cohort which included mentoring and coaching from top fintech experts, discovery sessions, support for APIs and software development, networking with the startup and fintech community, workspace, business network and guidance on funding investigation. The fintechs have also been encouraged to leverage the Visa Developer Platform (VDP), which provides simplified and user-friendly access to many of Visa’s most in-demand products and services through APIs, allowing anyone to transform great ideas into new digital commerce experiences.

For further information on the Program: Visa Innovation Program

Demo Day agenda

Welcome

16:00–16:10 Welcome speech from Andreana Pappas, Head of Visa Greece Introduction by Sevdalina Vassileva, General Manager, SEE — Greece, Bulgaria, Cyprus, Visa

16:10–16:15 Presentation of the Visa Innovation Program, Foteinou Vicky, Program Manager, Crowdpolicy

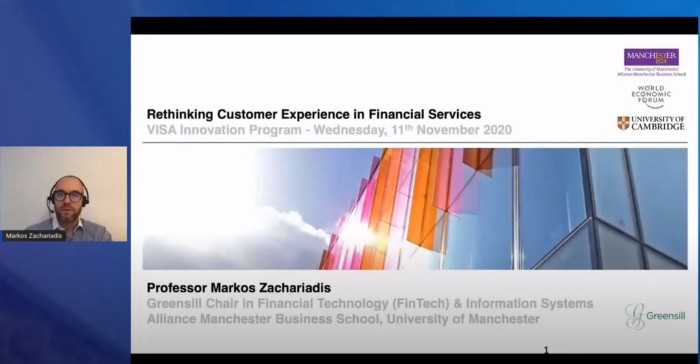

16:15–16:30 Keynote speech Rethinking Customer Experience in Financial Services, Professor Zachariadis Markos, Greensill Chair in Financial Technology (FinTech) & Information Systems at Alliance Manchester Business School and Member of the World Economic Forum’s Global Future Council on Responsive Financial Systems

Keynote speech, Prof. Markos Zachariadis, Greensill Chair in Financial Technology (FinTech) & Information Systems at Alliance Manchester Business School and Member of the World Economic Forum’s Global Future Council on Responsive Financial Systems

Cohort 1–16:30–16:50

16:50–17:10 Q&A — Discussion for the companies of Cohort 1.

Hanialidis Alexandros, Head of Digital Channels Management, Attica Bank, Leontiou Maria, Head of Innovation Center, Eurobank, Eleftheria Krithimou, Digital Products Senior Manager Visa, Trachana Dora, Associate, Unifund, Vaitsas Konstantinos, Head of Digital Innovation, Alpha Bank

Panel

17:10–17:30 Fintech growth in the new era!

Chatzipetrou Athina, President and Chief Executive Officer, Hellenic Development Bank, Ozan Ozturk, Head of Strategy & Market Planning South Eastern Europe, Visa, Karamanolis Giorgos CIO/CTO, Crowdpolicy, Tomov Daniel, Managing Partner, Eleven Ventures, Moderator Kalogerakis Konstantinos, Chief Innovation Officer, Crowdpolicy

Cohort 2–17:30–17:50

17:50–18:10 Q&A — Discussion for the companies of Cohort 2.

Armeniakos Spyros, Senior Director Merchant Acquiring & E-Payments, Piraeus Bank, Nikolov Todor, Senior Account Manager, Client Engagement Visa, Mousmoulas Yorgos, Partner, Metavallon, Trigkas Alkiviadis, Digital Transformation Division, National Bank of Greece

Virtual Networking

18:10–19:10 Virtual booths and networking

Event moderation by Ms Maria Akrivou, Senior Editor Fortune Greece.

Following the event, a virtual networking was held among the fintechs the VCs, executives, participants of the Demo Day in their virtual booths.